Banking on the cloud: Why financial services are moving HR and payroll to modern platforms

Financial institutions across Europe are replacing decades-old HR and payroll systems with modern cloud platforms, but the transition requires more than just new technology. Danske Bank's journey to consolidate four separate Nordic payroll vendors into a single unified solution demonstrates how banks can successfully navigate this transformation through clear governance, strong partnerships and realistic expectations about organisational change.

This article explores the specific challenges facing banking HR operations and examines how one of the region's largest financial institutions approached modernisation whilst maintaining regulatory compliance and employee trust.

The transformation challenge facing banking HR

Financial institutions face unique pressures when modernising HR and payroll infrastructure. Regulatory compliance requirements change frequently, workforce expectations have shifted dramatically, and the technology debt accumulated over decades has become a genuine operational risk.

Many banks continue to operate payroll systems built in the 1990s or earlier, patched repeatedly but never fundamentally redesigned. The result is often a fragmented landscape where different countries run separate systems, making it nearly impossible to gain a consolidated view of workforce data or ensure consistent compliance standards.

The banking sector faces several distinct challenges. First, the regulatory environment demands absolute precision in payroll processing and record keeping. Any system failure can trigger serious compliance issues and reputational damage. Second, banks typically operate across multiple jurisdictions, each with its own employment law requirements. Third, the sheer scale means any transformation affects thousands of employees and requires careful change management.

Why cloud platforms offer a strategic solution

Cloud-based HR and payroll platforms address these challenges by providing the scalability and flexibility banks need to operate across multiple countries whilst maintaining a single source of truth for employee data. They offer regular updates that keep pace with changing regulatory requirements without requiring internal development resources and provide mobile-enabled interfaces that meet contemporary employee expectations.

Standardisation becomes possible when organisations adopt cloud platforms designed around best practices rather than legacy processes. For banks willing to embrace this shift, the benefits include reduced operational complexity, lower maintenance costs, and the ability to redirect technology resources towards more strategic initiatives.

How Danske Bank approached Nordic transformation

Danske Bank's journey illustrates how a major financial institution can successfully navigate this transition. With approximately 20,000 employees spanning the Nordic region, the bank faced many challenges common to large financial services organisations. Four years ago, they operated payroll through four different vendors across their Nordic markets, creating operational complexity and making it impossible to gain a consolidated view of workforce data.

A governance review in Sweden revealed an opportunity to strengthen the bank’s payroll setup. Danske Bank partnered with Zalaris to implement a new solution within a short timeframe, creating a solid foundation for the broader Nordic programme.

Janne Pedersen, Nordic Head of HR Services at Danske Bank, explained the operational reality: "One system gave us apples, another gave us bananas. You can't visualise data like that for managers." Beyond the data challenge, the bank was dealing with outdated user interfaces that had become an embarrassment. Kasper Willemann, Head of People Tribe, recalled showing new employees a payroll system with a grey screen and blinking cursor dating back to 1999.

More seriously, the fragmented landscape created genuine operational risks. The bank experienced months where certain employee groups received double salaries or senior executives were not paid at all. As Willemann noted, "We couldn't trust that people actually got paid correctly. That uncertainty was simply not acceptable."

Building the foundation: Governance and standardisation

Danske Bank's approach centred on establishing clear guiding principles at the outset. During their first steering committee meeting for the Danish implementation, the team committed to a fundamental rule: they would not customise the new system unless changes were legally required.

Pedersen described how this worked in practice: "Every time we asked for a change, we looked at it and agreed whether this was a legal requirement. If it was, we could go to Zalaris and say this is legally required and you have promised to live up to all legal requirements. That saved us from a lot of arguments."

The bank's timing was fortunate. Over the preceding five years, they had been working to shift organisational culture towards standardisation. Willemann explained, "Five or six years ago, we put standardisation in slides, but every time we actually had something to implement, it was always 'I want it like this' or 'I want it like that.' Today it's a super powerful argument to ask: is this the standard way? Is this how the vendor has designed the product? If not, then we need to change our ways of working."

This cultural shift meant the transformation team had organisational support for saying no to customisation requests, even when those requests came from senior stakeholders.

Managing change and adoption

Despite positive reception to the new system, Danske Bank discovered that enthusiasm for change does not automatically translate into smooth adoption. Pedersen reflected on the experience: "People loved the new system but still wanted it to work like the old one. Do not underestimate the value of change management and the time required. We underestimated the strength of old habits."

The bank found creative ways to drive initial adoption. On implementation day, they served cupcakes at all locations with QR codes on the icing that employees could scan to download the new mobile app. The approach worked almost too well, with more than 4,000 registrations in the first 24 hours, triggering security alerts that temporarily shut down access because the volume appeared suspicious.

However, downloading the app was only the first step. The more persistent challenge has been changing manager behaviours. Under the old system, time and absence registrations simply flowed through without active approval. The new system requires managers to approve registrations to ensure data accuracy. Five months after implementation, the bank was still working to embed these new processes.

The role of HR and IT collaboration

Both Pedersen and Willemann emphasised that the programme's success depended on close collaboration between HR and IT functions. Danske Bank organises around tribes that include both IT leadership and business leadership in the same team, jointly prioritising work and making decisions together. This structure eliminates the traditional dynamic where IT and business functions compete for resources.

Pedersen described their working relationship: "The most important thing between IT, operations and business is trust. We agreed on the approach and then we trusted that was the approach we were bringing to the rest of the organisation."

They also established a shared vocabulary early in the programme. After a challenging initial period where different teams seemed to be talking past each other, they created what Pedersen called a dictionary of commonly used terms that were causing confusion. Taking time to ensure everyone understood the same thing when using specific terminology eliminated many subsequent misunderstandings.

Partnership approach with Zalaris

The transformation is supported by a strategic partnership with Zalaris that is gradually replacing the bank's previous landscape of multiple vendors. Pedersen noted, "With Zalaris we had a shared understanding of how we wanted to work. Trust, good collaboration, and everyone feeling safe to bring issues to the table." This foundation of trust has been essential in navigating decisions, managing unexpected challenges, and maintaining momentum as the programme expands across countries.

As the implementation expands to additional countries, the team takes lessons learned from each deployment and updates their guiding principles accordingly, creating a continuous improvement cycle.

Current status and future direction

Danske Bank successfully implemented the new solution in Sweden and Denmark, covering approximately 16,000 employees. A project to deploy in Finland is underway with an expected go-live at the end of November 2026, which will bring three of the bank's major Nordic markets onto the unified platform. Plans are in place to extend to Norway and Lithuania subsequently.

The impact on employees has been immediately visible. Willemann shared, "People literally stop me in the office to say thank you for replacing the old system." The mobile-first approach has fundamentally changed how employees interact with time and absence management.

Explore how Danske Bank is transforming HR and payroll across the Nordics with a unified cloud-based platform: Recorded live at Rethink! HR Tech Nordic 2025

More importantly, the bank has restored confidence in a fundamental employment contract: that employees will be paid accurately and on time. Willemann noted this certainty was essential to justify the investment. "With a Maslow's hierarchy approach, if people don't get paid or have uncertainty about whether their employer can pay salaries correctly, nothing else matters."

Lessons for other financial institutions

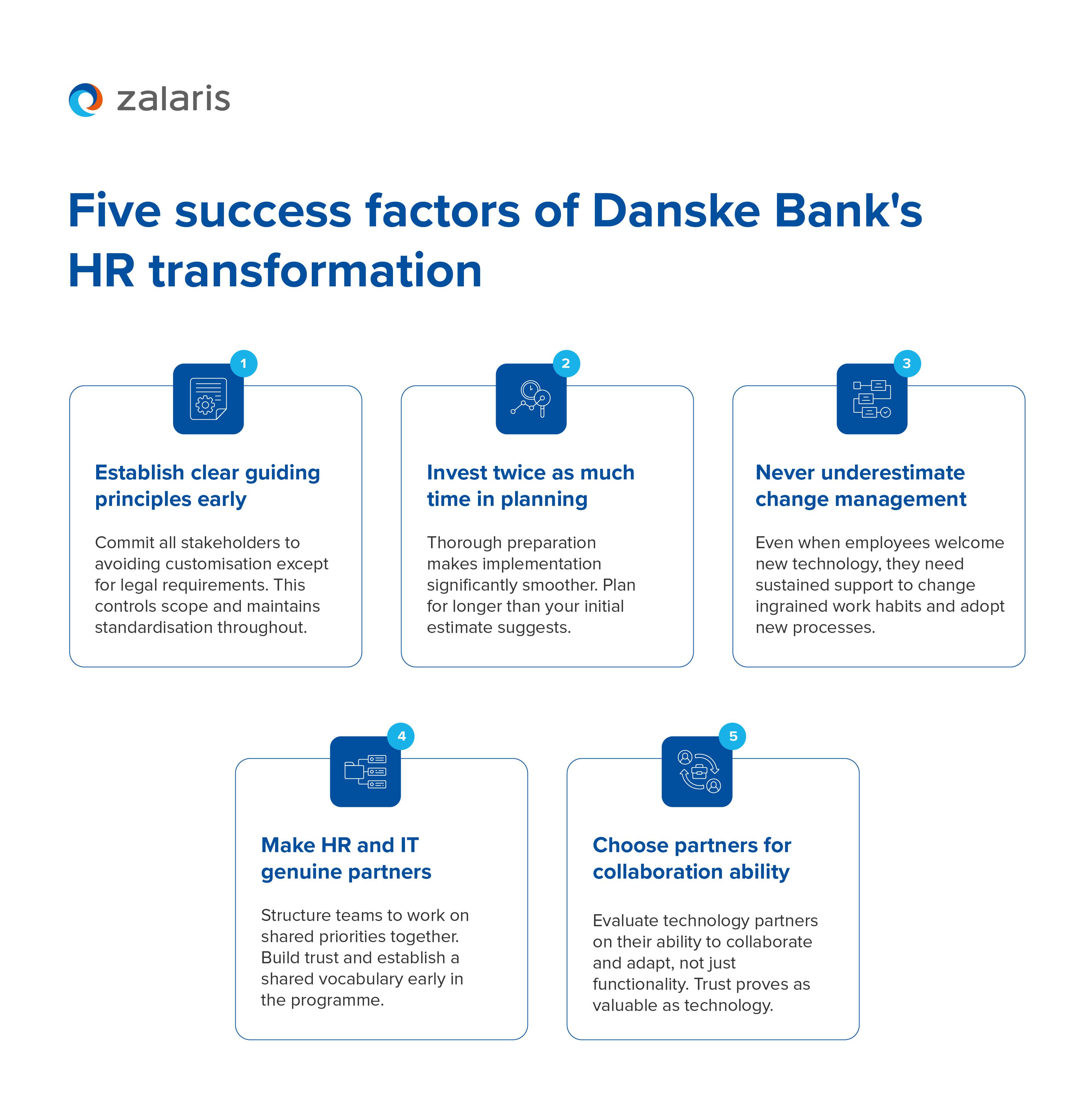

Danske Bank's experience offers several lessons for other financial services organisations. First, establish clear guiding principles early and ensure all stakeholders commit to them. The decision to avoid customisation except for legal requirements proved essential in controlling scope and maintaining standardisation.

Second, invest more time in planning than initially seems necessary. Pedersen recommended spending twice as much time on planning as first estimated, as thorough preparation makes implementation significantly smoother.

Third, do not underestimate the change management challenge. Even when employees welcome new technology, they need support to change ingrained work habits and adopt new processes.

Fourth, ensure HR and IT functions work as genuine partners rather than separate organisations with competing priorities. The structural and personal trust that Danske Bank built between these functions was fundamental to their success.

Finally, choose technology partners based on their ability to collaborate and adapt, not just on functionality. The relationship between Danske Bank and Zalaris has been characterised by mutual trust and shared commitment to finding solutions, which has proved as valuable as the technology itself.

Moving forward

The banking sector's HR and payroll transformation challenge is not primarily technical. The cloud platforms and functionality required to run modern HR operations exist and are proven. The real challenge is organisational: building the governance structures, collaborative relationships and change management capabilities needed to move away from legacy systems and processes that have been in place for decades.

Danske Bank's journey demonstrates that this transformation is achievable when approached with clear principles, strong partnerships and realistic expectations about the change required. Their experience also shows that the benefits extend beyond operational efficiency to fundamental improvements in employee experience and organisational confidence.

Zalaris has supported financial institutions across Europe in navigating this transformation. Our expertise in banking sector requirements, combined with proven experience in cloud HR and payroll implementations, enables us to partner with organisations at every stage of their modernisation journey. If your organisation is considering a similar transformation, we would welcome the opportunity to discuss how our approach might support your specific requirements. Get in touch with us to arrange an initial consultation.

Frequently asked questions (FAQ)

Table of Contents

- The transformation challenge facing banking HR

- Why cloud platforms offer a strategic solution

- How Danske Bank approached Nordic transformation

- Building the foundation: Governance and standardisation

- Managing change and adoption

- The role of HR and IT collaboration

- Partnership approach with Zalaris

- Current status and future direction

- Lessons for other financial institutions

- Moving forward