Unifying HR and Payroll: The case for one partner and zero fragmentation

Modern organisations have invested in HR and payroll technologies to simplify operations, improve compliance and enable better workforce decisions. Yet many HR leaders struggle to realise the value of their investments due to fragmentation.

Elliot Raba

The disconnect between projected business outcomes and practical realities is clear: HR transformation has delivered modern systems, but it has not always delivered operational simplicity.

HR technology is now more advanced than ever, but operating models have not kept pace and fragmentation persists. As a result, HR professionals spend too much time resolving errors, reconciling data and compensating for disconnected processes.

This fragmentation is a global reality. A recent Deloitte Global Payroll Benchmarking Survey found that the average company uses nearly four different payroll technologies globally, with even greater fragmentation in certain regions.

Organisations are realising that true transformation is not achieved when a system goes live - It is achieved when operational performance is continuously delivered. That change requires a single accountable partner across implementation and ongoing payroll operations.

This article examines why fragmented HR and payroll environments have become a strategic issue, how they restrict the delivery of modern workforce strategy, and why a unified partner model is increasingly the solution chosen by leaders who expect HR to operate with confidence, accuracy and a direct line of sight to business results.

Fragmentation as a barrier to operational confidence

Fragmented technology does not usually begin as a deliberate strategic choice. It develops over time in response to local needs, acquisitions, regulatory events and successive layers of digital investment.

New systems are added without the time or ownership needed to refine older models, and integrations are introduced as patchwork solutions rather than as part of a cohesive architecture. As complexity increases, responsibility is distributed between in-house teams and multiple providers, and operational risk increases.

The lack of a single source of truth for employee data impacts every aspect of HR operations, including:

1. Siloed data and duplicate employee records

When HR, payroll and time systems do not speak to one another, data must be entered more than once. Over time, inconsistencies emerge – this could look like Start dates differing start dates, allowances appearing in one system but not another, name changes recorded in payroll but not in benefits, and many more.

Every discrepancy requires human effort to reconcile and introduces the risk of errors that directly affect accuracy. The work of maintaining alignment becomes an ongoing operational burden rather than an automated process.

2. Compliance and security risks

Data fragmentation makes it more difficult to track who has access to sensitive employee information and whether local regulations have been consistently applied. Updates to tax rules, statutory reporting formats or employment law must be replicated across every system and every provider. This creates timing gaps where incorrect deductions can be made or reporting deadlines missed.

Without central ownership, it is challenging to ensure compliance with regulatory requirements like GDPR, such as data minimisation and retention controls.

3. Inefficient workforce planning

When employee data resides in multiple places, organisations lose clarity on the true cost and composition of their workforce. Headcount, vacancies, overtime and contingent labour spend are often reported manually, and leaders must make decisions based on outdated or incomplete information.

Forecasting becomes reactive rather than strategic if HR must continuously validate data before modelling future scenarios.

4. Inaccurate reporting and analytics

Modern HR strategies depend on high quality data to track engagement, productivity and business outcomes. Yet, fragmented systems create reporting delays and undermine confidence in the numbers. HR analysts often spend longer cleansing data than deriving insight. Executives become wary of dashboards that are frequently challenged. As a result, organisations struggle to demonstrate the impact of transformation and lose opportunities to drive improvement based on evidence.

5. Increased manual administration

While HR technology is intended to reduce routine administrative tasks, fragmentation often reintroduces the need for manual effort. Teams manage batch uploads, re-enter changes and track down missing information. This increases reliance on individual knowledge rather than setting up standardised workflows.

These tasks continue to consume capacity long after go-live, limiting the ability of HR teams to focus on strategic initiatives.

6. Poor employee experience

Employees and managers expect consumer-grade digital experiences, but fragmentation delivers the opposite. Password fatigue, varying interfaces, delayed updates and inconsistent policy application undermine trust in HR services. When tasks are difficult, people revert to email or informal workarounds, which introduces new errors and increases the burden on HR teams.

The cost to the organisation is twofold: Expensive technologies remain under-utilised, and employees avoid using intended processes and self-service options. For employees, complicated processes increase frustration and time spent on administrative tasks. According to Deloitte’s Human Capital Trends Report 2025, 41% of daily work is spent on non-value-added tasks – fragmentation compounds this problem.

Operational inefficiencies remain largely invisible within reporting dashboards, yet they consume hours of HR capacity each month. They slow people down, mask avoidable errors and absorb effort that should be focused on value creation. Fragmentation does not only create operational noise - it systematically prevents HR and payroll teams from delivering work with confidence, accuracy and speed.

The effect of fragmentation on payroll operations and governance

In a quick-poll by the Chartered Institute of Payroll Professionals (CIPP) in the UK, 41% of payroll professionals said their organisation’s agreed accuracy target was 98-99% (with 29% saying 100%). However, Remote’s ‘2024 State of Payroll Report’ discovered that 40% of employees have experienced a payroll error in a 12-month period.

This disparity demonstrates an ongoing gap: Organisations are striving to drive accurate payroll cycles, while employees suffer due to inaccuracies. Fragmentation is a major risk to payroll accuracy.

Siloed systems undermine accurate master data, complete time information, and reliable calculations. This is particularly challenging for global organisations who must align with regulations in every location.

When data flows are inconsistent, payroll teams become responsible for managing exceptions rather than running a process. Month end becomes a period of heightened pressure and manual controls, and strategic initiatives are deferred to keep operations stable.

Some common payroll challenges with fragmented HRIS systems include:

1. Master data inconsistencies

Small discrepancies in job data, pay elements or working patterns create exceptions that ripple across calculations. Payroll teams spend time reconciling changes rather than processing pay, and errors can remain hidden until a payment fails.

2. Time and attendance mismatches

When time capture systems are not fully integrated, payroll receives late, partial or manually compiled inputs. This increases the risk of incorrect pay for hourly workers and adds pressure on cut-off cycles where accuracy matters most.

3. Delayed statutory updates

Tax, pension and reporting changes are often applied first in one system, then manually in others. Timing gaps across solutions introduce compliance exposure, particularly in multi-country environments with frequent legislative updates.

4. Limited visibility of HR changes

Contractual variations are not always reflected in payroll workflows at the moment they occur. Teams rely on informal communication to fill the gaps, which creates inconsistency and makes governance difficult to demonstrate.

5. High levels of manual controls

The more fragmented the landscape, the more payroll relies on manual checks to guarantee correctness. Exception logs grow, cut-off windows compress and valuable expertise is dedicated to troubleshooting errors rather than optimisation.

6. Deteriorating employee trust

Payroll errors have a direct human impact. Research shows that 49% of employees consider leaving after two payroll errors. Even a single incorrect payment can reduce confidence in HR services and create avoidable employee relations issues. Recovery work adds further burden to HR teams who are already stretched thin.

A fragmented HR and Payroll model is not sustainable in a regulatory environment where the pace of change is rising, and the cost of non-compliance can be severe. It also undermines the workforce experience organisations intend to offer. Employees expect access to personal information, transparent leave balances, accurate time and pay, and self-service in one place.

Why technology alone is not the answer: HR operating models must keep pace

Most organisations have relied on major technology programmes to improve HR and payroll. New cloud systems have delivered improved user experience and innovation potential. However, the implementation of technology is often separated from the design and delivery of ongoing services.

The moment the project ends, responsibility is siloed. Internal teams, multiple vendors and local payroll providers all take ownership of their particular area. When processes break and errors arise, accountability is hard to pinpoint.

The Chartered Institute of Personnel and Development highlights another critical disconnect: While technology adoption accelerates, the necessary upskilling of HR professionals to leverage it effectively lags severely. CIPD research suggests that only 40% of businesses provide sufficient training to HR professionals to support the transition to a new operating model.

A system cannot deliver continuous value if the operating model around it has not transformed as well. To resolve this deep-seated lack of alignment and complexity, a fundamental shift toward unified ownership and delivery is crucial.

One Partner – from technology solutions and managed services

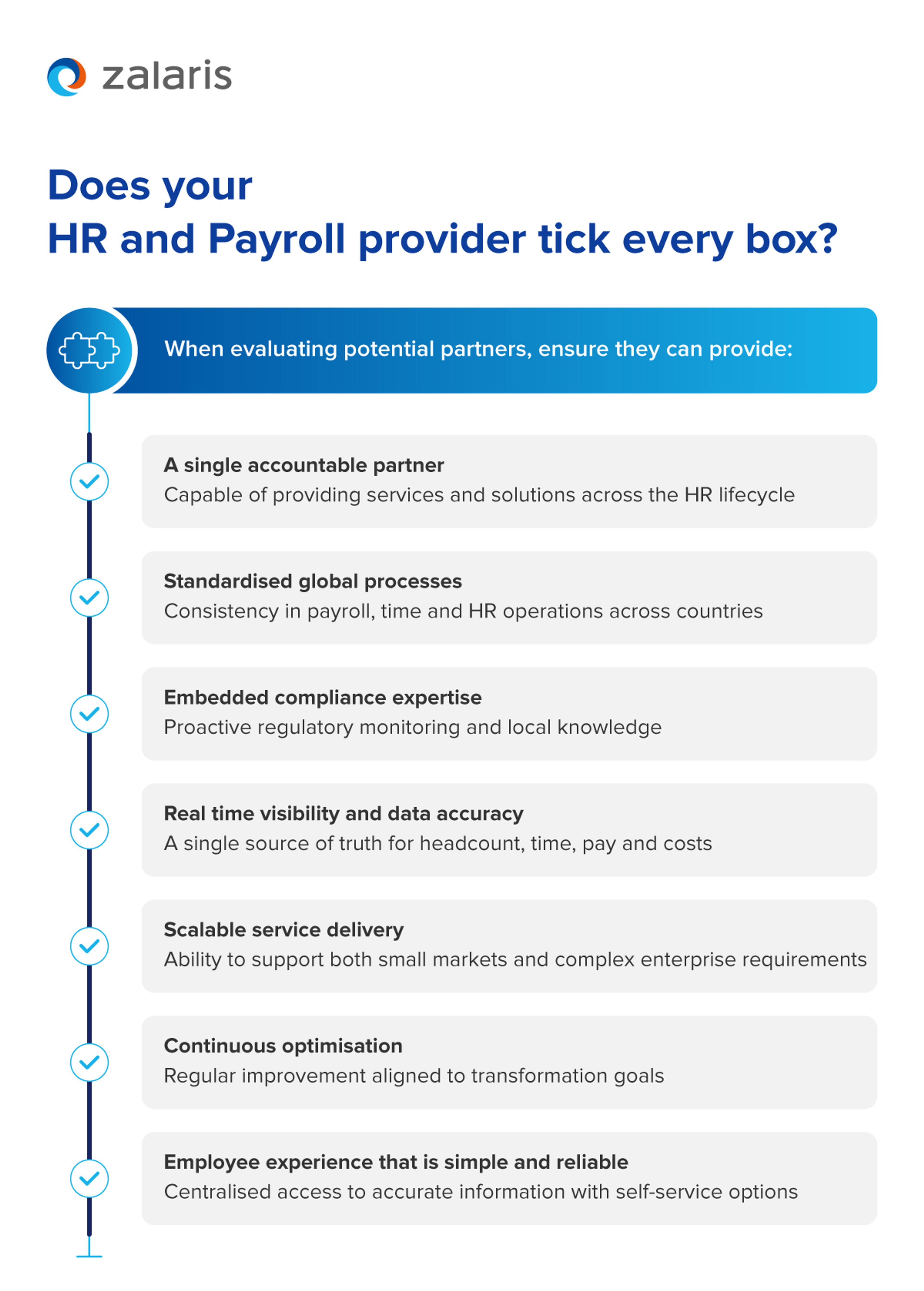

HR leaders are evaluating service models that ensure collective accountability across technology and operations from the outset. Instead of separating implementation and support, one partner remains responsible for maintaining system health, ensuring integration governance, operating payroll and delivering proactive improvement.

The fragmentation crisis highlights the urgent demand for this unified approach: While the average company works with nearly four separate third-party providers worldwide, a significant 68% of organisations are actively undergoing payroll or HR transformation and vendor consolidation to address this complexity.

A fully aligned, single source model of HR and Payroll administration has several advantages:

- Design decisions are informed by operational knowledge and compliance expertise.

- Data governance is consistent throughout the system lifecycle.

- Integrations and reporting structures evolve with the organisation rather than becoming outdated.

- Payroll operations are connected directly to system capability rather than dependent on workaround processes.

- Issues are resolved at the source, so errors do not repeat.

This is not simply a support model. It is a strategic service partnership that ensures the objectives established during transformation are still being achieved several years later. Technology and service performance move together, and accountability for outcomes is clear.

Preparing for transition

The move to a unified partner model should be planned with the same discipline as technology transformation. The organisation assesses the current state of its processes, integrations and service levels. It establishes clear expectations for future operating performance and ensures that accountability structures are aligned with business priorities.

Unify HR and Payroll processes with Zalaris

Moving from fragmented vendors to unified partnership requires clear accountability and strategic planning. The One Partner model delivers technology implementation, managed operations and continuous optimisation under single ownership, eliminating the execution gap that causes traditional HR transformation to underdeliver.

FAQ

Related Content

Elliot Raba

Enterprise Sales Executive

Elliot is a dynamic and results-driven Enterprise Sales Executive at Zalaris UK&I, where he excels in crafting innovative solutions that address the unique needs of his clients. With a keen understanding of the intricacies of enterprise level operations, Elliot leverages his extensive industry knowledge to drive business growth and foster lasting partnerships.

Table of Contents

- Fragmentation as a barrier to operational confidence

- 1. Siloed data and duplicate employee records

- 2. Compliance and security risks

- 3. Inefficient workforce planning

- 4. Inaccurate reporting and analytics

- 5. Increased manual administration

- 6. Poor employee experience

- The effect of fragmentation on payroll operations and governance

- Why technology alone is not the answer: HR operating models must keep pace

- One Partner – from technology solutions and managed services

- Preparing for transition

- Unify HR and Payroll processes with Zalaris