Overview of the solution:

Zalaris’ Pay On-Demand solution aids companies of all sizes in maximising financial transparency and establishing financial stability among the employees by offering the ability to access a portion of their earned income early and prior to their scheduled pay day. Our key objective is to assist our clients in achieving financial success and promote a more flexible payroll option that makes them an ‘employer of the future.’

Features of the solution:

For Employees:

- Empowers employees with early access to a portion of their earned income before the scheduled pay day.

- It improves financial stability and allows for better visibility and planning.

- Provides a safety net for employees in the event of unanticipated financial challenges.

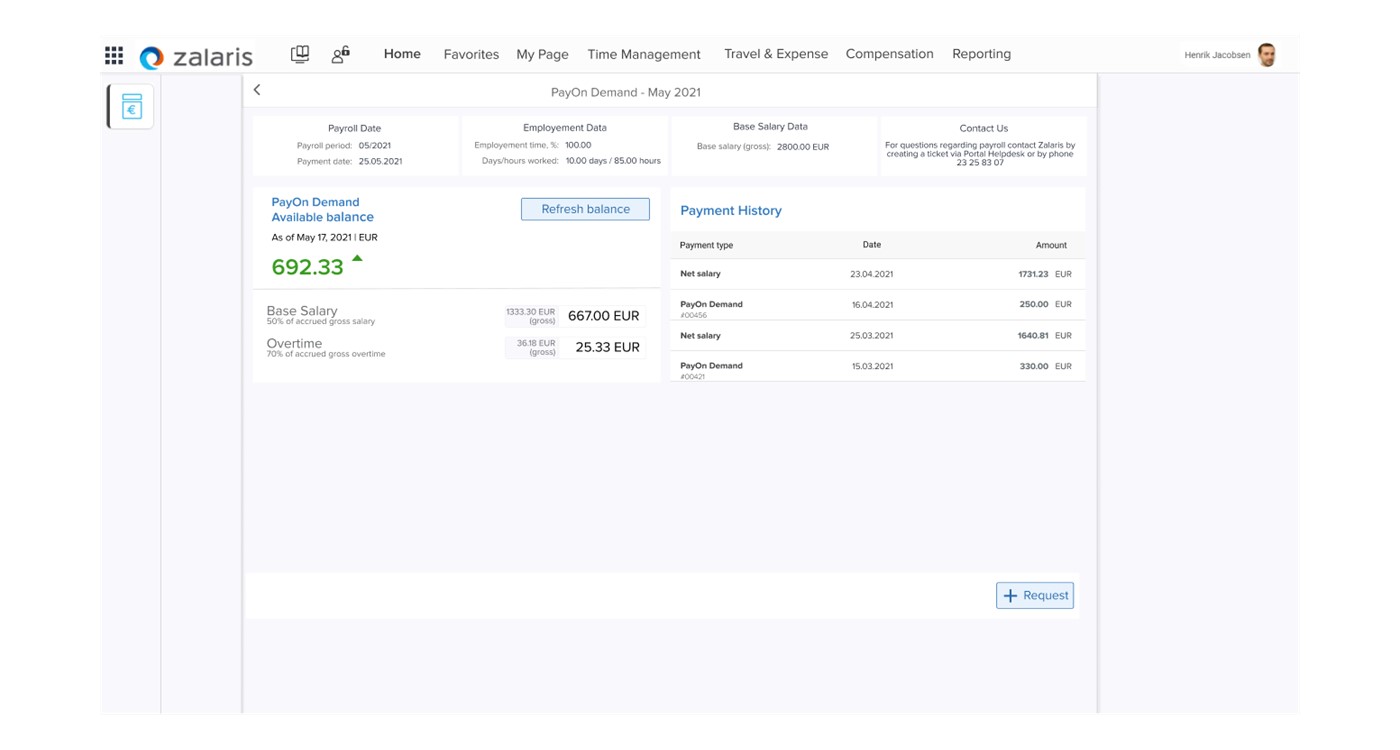

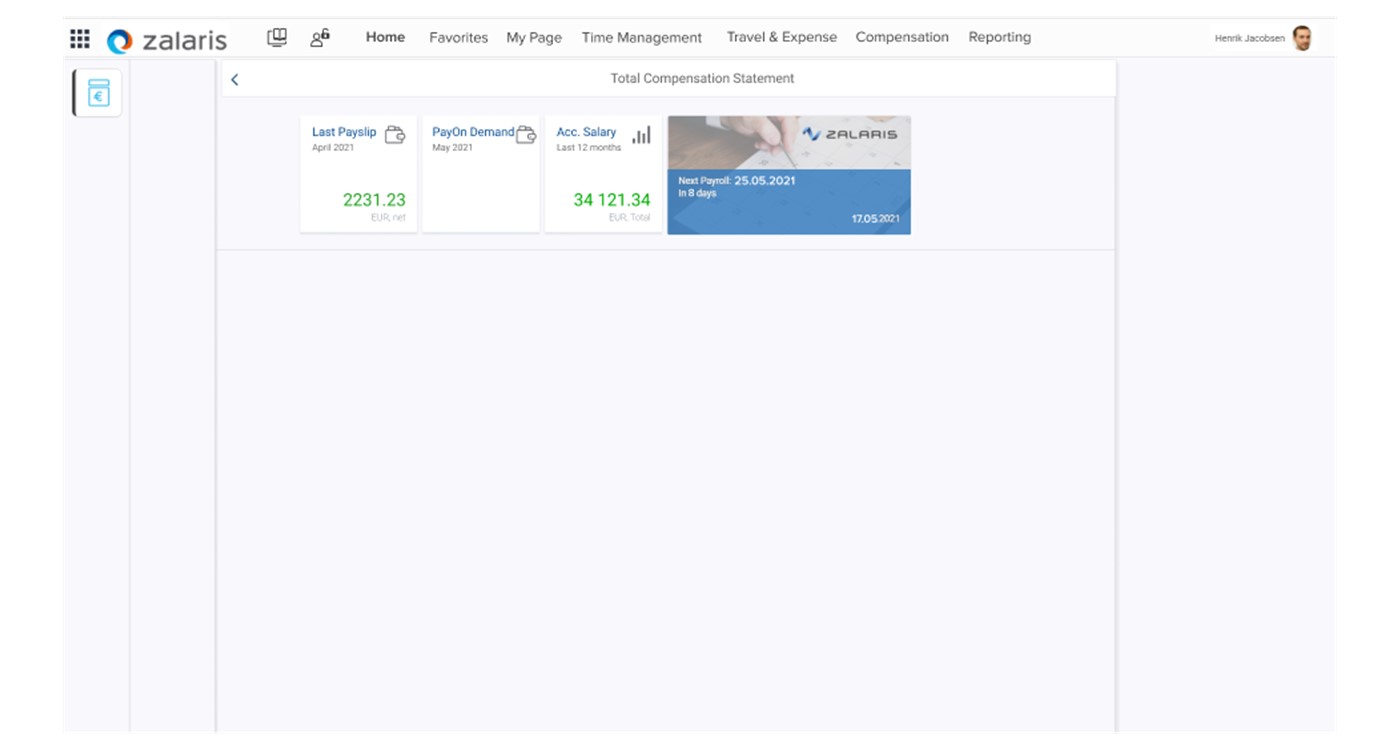

- Easy access via Zalaris PeopleHub portal and mobile application.

For Employers:

- Customisable and scalable solution as per the clients and employees needs; percentage accessible, availability; and other relevant decisions are aligned according to their growth strategy.

- Fully automated solution that recalculates payroll as and when earned pay is accessed prior to the pay day, ensuring zero intervention required from the employer while producing the right pay is calculated during the regular payroll run.

- Guardrails and limitations that are easily configurable.

- Enables businesses to become the workplace of the future.

- User-friendly portal with GDPR compliance.

Benefits of the solution:

With a majority of the workforce living lives between paychecks and finding themselves at the mercy of exorbitant interest rates, bank charges and loan sharks, Zalaris’ Pay On-Demand solution comes in to help fortify employee experience within companies.

Proving to be a financial guardrail for employees by safety proofing them through unexpected expenses, Zalaris’ Pay On-Demand solution helps establish a better visibility into earnings for effective budgeting and planning. This solution enables employees to instantly access a portion of their earned pay before the scheduled pay date, with the remaining earned income being processed during the scheduled pay date.

Early Wage Access (EWA) by Zalaris strengthens the employee’s financial well-being and simultaneously improves the productivity of the employers workforce. Its distinctiveness offers a competitive edge in the battle for top talent, making recruitment and retention a seamless affair.

Zalaris’ Pay On- Demand is tolerant to varying demographics by being legally compliant with local regulations. By providing regulators, Zalaris ensures that the organisation controls the various attributes of the solution based on the guidelines and norms of the company.

The main aspects of the solution is customisable ensuring that the employees avoid making excessive withdrawals from their earned money that would make payday difficult. Thanks to safeguards, employees cannot obtain funds they haven’t earned.

How does it scale your HR & Payroll?

A fully automated solution that removes the strenuous process of manual recalculations and back-and-forth approvals involved in the traditional Pay On-Demand payroll process. With Zalaris, organisations can adopt Pay On-Demand with zero manual intervention and maximised technology while keeping it customised as per the company. The accessibility of the solution, the frequency of withdrawal, and the underlying conditions are all solely dependent on the organisation and the employers.

Zalaris’ Pay On-Demand solution can be accessed from the Zalaris PeopleHub portal effortlessly through a straightforward process, making the entire procedure a user-friendly and discreet one. The service can be available to the entire workforce or employee groups based on the company’s requirements. Thanks to strong security and authentication, only the employee’s bank account will be used for payments and the entire process is electronically approved, eliminating the need for manual approvals.

With Zalaris’ Pay On-Demand solution, it is now possible to experience “click to get paid” through flexible and secure payroll processing.

Want to get started? Get in touch with our experts today.