As you would know, labour cost reflects the time and effort which has gone into producing the manufactured unit or providing a service. For example, wages paid to employees working directly in the production of a product or service.

However, the dilemma faced by many employers is about, how to re-allocate some of the employer on-costs, like the payment towards employers National Insurance (NI), employers pension, and other employer payments, against the respective cost centres. In most payroll solutions, these are generally allocated to the home cost centres of the employees. This process is correct only when the employee permanently works under one cost centre, which is their home cost centre. It is a headache mainly for those Industries where the employees tend to take up different jobs under different cost centres and the re-allocation of on-costs becomes a problem. The finance departments normally end up doing the dirty job of manually reallocating the on-costs based upon certain predefined percentages made up of estimates and assumptions. Accounting journals are often created to reallocate the agreed proportion of the costs.

This article is intended to highlight the SAP functionality using payroll function XDEC, to achieve the re-allocation of on-costs automatically during a payroll run.

Payroll Function XDEC

In an SAP standard solution, employer on-costs, are not automatically distributed to all the cost centres which have absorbed an amount of the employee time that is associated with the on-cost. However, during the early 2000’s, SAP introduced initial functionality to automate this process. A new payroll function was added for use in the UK payroll schema. The pilot implementation was done at Hampshire County Council and was mainly focused on public sector clients. Over the years, the XDEC functionality has been more widely used outside the public sector.

Payroll function XDEC uses weighted average cost basis to automatically calculate the appropriate proportion of on-costs for each cost centre. This may then be used to automatically post the accounting entries as part of the standard payroll posting process to the chart of accounts in finance. In the UK, the following on-costs are normally requested to be reallocated in payroll:

- Employer National Insurance Contributions (NIC)

- Employer pension contributions

- Employer health plan contributions

- Apprenticeship levy

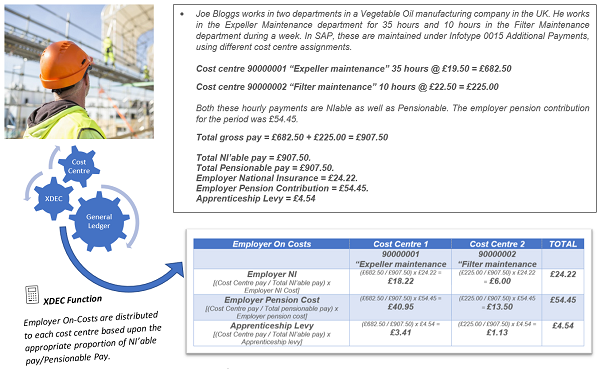

Illustration of the ‘On-Cost’ reallocation using XDEC:

The following scenario will illustrate the cost reallocation using XDEC:

Figure 1: Illustration of on-cost reallocation

SAP carries out the on-cost reallocation to the different cost centres, automatically in payroll using XDEC function. It updates the COSTS table with the relevant cost reallocation information.

Figure 2: COSTS table in SAP

Figure 3: COSTS table detailed view showing ER NIC reallocations against different cost centres.

Implementing XDEC in SAP Payroll

The following steps are to be completed to implement XDEC functionality in SAP.

-

T77S0 – Switch

XDEC is activated using the system table T77S0 switch, where group name is HRPSX and semantic abbreviation is XDEC. The default setting in SAP is that XDEC is inactive.

Figure 4: XDEC Activation switch in T77S0 “System table for switches.

-

Base Distribution Grouping

The next step is to create different cost bases (Base Distribution Groups) using the table V_T7PBSDEC_WTGRP. For example, NI’able Pay, Pensionable pay etc., can be used as the base distribution groups. They group different source wage types like Salaries and Allowances, which are used to make up the base distribution group. For example, Monthly salary and London allowance, make up the base distribution group “NI’able gross” for an employee, which is then used to calculate the total employer’s NI contribution.

Figure 5: Base distribution group table V_T7PBSDEC_WTGRP.

Base wage type grouping is a two-character identifier for a group of wage types to be used as the basis for distributing employer’s costs.

Figure 6: Table V_T7PBSDEC_WTGRP detailed view

Base distribution groups can be defined in many ways, such as using processing class, cumulation class, wage type grouping, or wage type sub-application. For example, Base distribution group for NI’able pay for UK, can be defined by using cumulation class 31.

If these options are not enough for your needs, you could also use a function module exit. However, only one method can be used to define the grouping. This grouping can be used to split many different costs, but an individual cost cannot be split across many groupings.

-

Cost Distribution Grouping

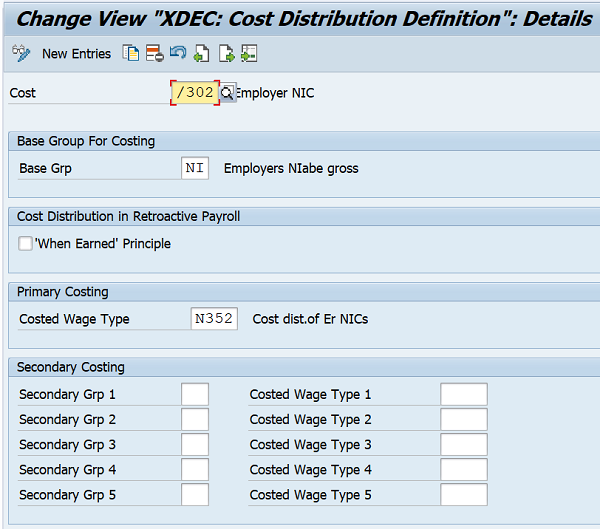

The next step is to define the cost distribution grouping using the customising table V_T7PBSDEC_COSTS. Here, you define how a cost wage type should be distributed. This will be associated with a base wage type grouping and a target wage type for that grouping. This target wage type will hold the cost reallocation along with the respective cost centre information. This is the wage type that will be posted to finance along with the cost centre information.

Figure 7: Cost Distribution group table V_T7PBSDEC_COSTS.

The “When Earned principle” checkbox is an indicator as to whether the costs should be calculated every period (when checked, value ‘X’), or only in the original period of the payroll run using the “When Paid” principle. For example, in the UK, pension contributions are calculated using the “When Earned” principle, and therefore cost distribution needs to occur every period. Whereas National Insurance Contributions (NIC) are calculated using the “When Paid” principle and so cost distribution needs to be performed only in the original period.

Figure 8: Table V_T7PBSDEC_COSTS detailed view.

In the above example the source wage Type /302 Employers NIC is grouped based on the base wage type grouping ‘NI’, (which uses cumulation class 31) which in turn generate the target wage type N352. This cost wage type carries the reallocated cost values, along with the cost centre assignments, for posting into finance.

Figure 9: Payroll Result table showing Costing Wage Types generated by XDEC.

During the processing of payroll, each cost centre that has been posted to with NI’able pay is identified and given an indicator “C1 identifier”. In the example above, C1 identifiers 0001 and 0002 have been attributed to cost centres 90000001 and 90000002, respectively. These cost assignment indicators are then marked against the payments so that the correct proportions of total NI can be determined.

Figure 10: Payroll Result table showing Costing Wage Types with C1 identifiers.

There are also options to include secondary cost distributions, which are always a subset of the base wage type grouping. Secondary cost distribution on wage type level is currently limited to 5 sets of wage types. The primary cost distribution will always be based on cost objects (C0 & C1).

-

Payroll Schema Changes

The XDEC function is not included in the payroll schema delivered as standard by SAP. Hence this function needs to be updated inside the customer version of the GEND schema (or the equivalent country version). The payroll function should only be called once at the end of the payroll schema, but just prior to the call to function GEXCP. No parameters are necessary for the function call.

Figure 11: Adding Payroll Function XDEC into Payroll Schema.

-

Removing the old NI Costing solution

When you adopt the XDEC cost solution, the old NI costing solution for UK payroll, must be removed from the payroll schema, to avoid NI being costed twice. In the case of single employments, the NI costing solution can be removed by taking out the PCR G302 as the second parameter wherever function GBNIC is called.

Figure 12: Removal of G302 costing rule.

In the case of multiple employments, NI costing solution can be removed by first taking out the single employment solution as above and then removing COST (C1 & V0) as the second parameter (third and fourth parameters) wherever GBPSC is called.

-

Posting adjustments using the generated Cost Wage Types

A few adjustments may need to be made with respect to the posting characteristics of the cost wage types, to ensure that the posting entries are made to the correct accounts without the need to modify the existing posting wage types and the cost distribution is included. New wage types may be required to be added to offset the existing posting rules.

Take the example of the ER NI Contributions, where the cost wage type N352 will carry the cost distribution generated by XDEC. You may need an additional wage type, say 935P (Offset employer NI which cancels the initial debit posting by wage type /302 to the home cost centre), to be added to correct the original posting for /302 (prior to cost distribution) which continues to be posted against the home cost centre. Wage type 935P will have a posting rule which is the same as that used for the cost centre posting for /302 but with the signage reversed.

The table below summarises the postings which take place for employer National Insurance with the introduction of the XDEC functionality.

Figure 13: Posting document showing NI Wage Type posting with cost distribution.

As you can see, the costing wage type N352 which was generated by the XDEC function, carrying the cost centre details and the distributed costs against each cost centre.

-

Negative Payments

Negative Payments causes XDEC to error for the employee unless such costs have been identified as such.

Negative entries can arise from salary sacrifice benefit schemes (Pensions, etc.) and/or from retrospective reduction in gross payments that are carried forward as negative entries into the current period. These are not true negative payments but are instead carried forward deductions in positive gross that do not have an equal or larger corresponding amount for the same wage type in the current period. They must be identified using the wage type grouping “NP” in base distribution grouping table T7PBSDEC_WTGRP. Such cost wage types are to be added to the definition of the wage type grouping ‘NP’.

Figure 14: Base Distribution Grouping ‘NP’ for negative payments.

Wage type grouping NP “Negative Payments” are already pre-defined in table T52D5. You will have to add all those payment wage types which forms part of the base distribution grouping and all those negative cost wage types specified in the cost distribution grouping, to the wage type group using table T52D7.

Figure 15: Wage Type Group Table T52D7 where negative wage types are added to WT Group ‘NP’.

Cutover to Live Client

Before going live with the XDEC functionality, it is important to populate the COSTS table for the payroll history i.e., for payroll periods that could be re-processed by running a retro-active payroll. This is because, XDEC assumes that you have always used XDEC, as there is no activation date concept for XDEC. One would have expected that SAP used GBCHG feature with an activation switch!

However, this process is not necessary for clients going live on SAP for the first time as they will not have any payroll history that needs to be converted. To help the cutover process, SAP has provided a conversion program to populate the table COSTS.

Figure 16: Conversion program for populating COSTS table, along with a program to Clear table.

The report RPUDECG0PBS_FILL_COSTS can be used to convert the COSTS table based on the payroll history.

A second program RPUDECG0PBS_CLEAR_COSTS can also be used to clear table COSTS, to aid testing.

Synopsis

SAP payroll users have been using other cost management tools like, infotype 0027 cost distribution and account assignment features within payroll infotypes. However, these are totally different to XDEC as they do not manage the distribution of employer on-costs. XDEC on the other hand processes the updates from IT0027/account assignments from infotypes, to reallocate the employer on-costs.

The XDEC functionality is currently activated only for UK and US. However, it can also be activated for use by other countries, after making necessary updates to the SAP include programs in the XDEC function. The enhancements are necessary because the other payroll programs may not be using the table PC2X0 which is referred to in GB payroll programs for generating the COSTS table. It may also be missing the data and form routines used by the XDEC function.

The cutover reports (RPUDECG0PBS_FILL_COSTS) may also needs updating, for usage in other countries.