Simplifying HR. Empowering people.

Zalaris creates seamless HR experiences that drive measurable impact.

We help organisations streamline HR and payroll processes across borders. From scalable cloud solutions to end-to-end managed services, we are your partner in boosting efficiency, enhancing compliance and unlocking the full potential of your workforce.

Satisfied customers from around the globe

25 years of powering HR success

We help you manage your HR & payroll operations from end to end – secure & compliant.

- Intuitive solutions

- Ongoing support

- Full compliance

Your partner in digital HR transformation - from impactful strategy to SAP precision

- Cloud transformation

- Strategic guidance

- Proven SAP expertise

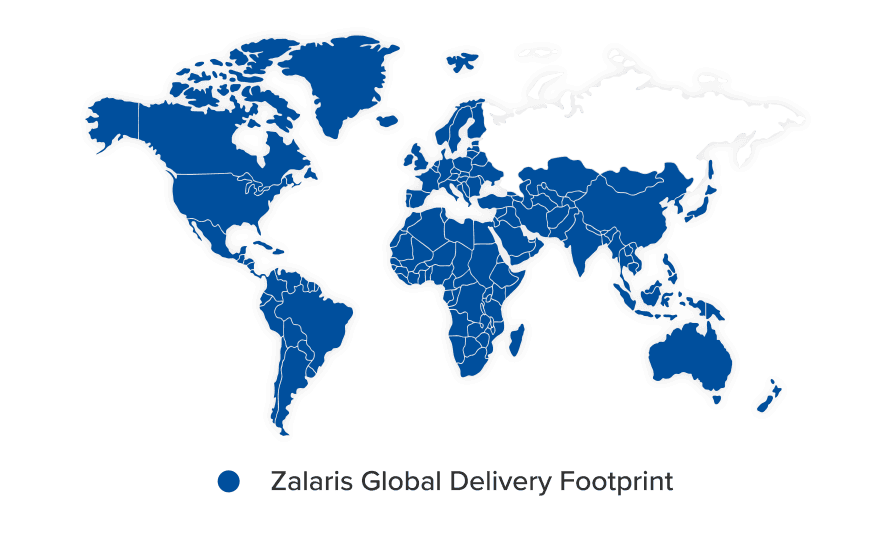

Global delivery meets local expertise

With a presence throughout Europe and the Asia Pacific, we deliver cross-border, centralised solutions tailored to local requirements in 150+ countries worldwide.

Our global footprintProven expertise you can trust

Employees served monthly

Countries covered

Clients Supported

Certifications held by our experts

Let’s reimagine HR together

Managing HR across borders is complex. Zalaris makes it simple with scalable solutions, deep HR expertise, and a clear focus on what matters most – your people.

- Global reach, local expertise

- Seamlessly compatible with leading HCM technologies

- Compliant and scalable

- People-first approach

Customer Success Spotlight

Transforming global HR: Innomotics partners with Zalaris for success

Zalaris supports the global player with worldwide HR and payroll services for more than 15,000 employees in over 40 countries.

Read full customer story

Together with Zalaris, Denmark’s largest bank is moving from fragmented local systems to a unified, cloud-based HR and payroll operating model across countries that delivers operational efficiency and improved employee experiences.

Zalaris provides a modern, comprehensive solution to integrate a specific module by using SAP SuccessFactors & SAP Integration Suite.

NEWS

Zalaris brings multi-country and regional HR & Payroll transformation expertise to Mastering SAP Collaborate Sydney 2025 as a Gold Sponsor

Looking for peace of mind in HR and Payroll? Let’s find the right solution together.

— Hans Petter Mellerud, CEO & Founder of Zalaris

Contact us

Join our team!

Help us revolutionise how companies manage their workforce across the world

Open positions

5K Your Way

This foundation was founded by Lucy Gossage, Oncologist at Nottingham City Hospital, a 12 times Ironman Champion and Gemma Hillier-Moses, International Runner and Founder of MOVE charity who was diagnosed with cancer herself at the age of 24 in 2012. Together with them, we want to raise funds and awareness to encourage those living with and beyond cancer, families, friends and those working in cancer services to stay active.

Read more about 5K Your Way

The legacy of the Norseman

Zalaris Norseman Xtreme Triathlon is considered the ultimate triathlon on the planet. It’s the race that any hard core triathlete should do at least once.

Read more about NorsemanFor investors – Zalaris ASA Q3 2025 Presentation

Watch webcastIR Mailing List

Register to our IR list. For general inquiries please use ir@zalaris.com.

Seamless integrations with leading HR and Payroll solutions

There are no hierarchical barriers in #teamZalaris. We work, play, and find the best solutions as one team!

— Hilde Karlsmyr, CHRO

Need a smarter way to manage HR and payroll?

Let’s discuss how Zalaris can simplify operations, ensure compliance, and support strategic growth.