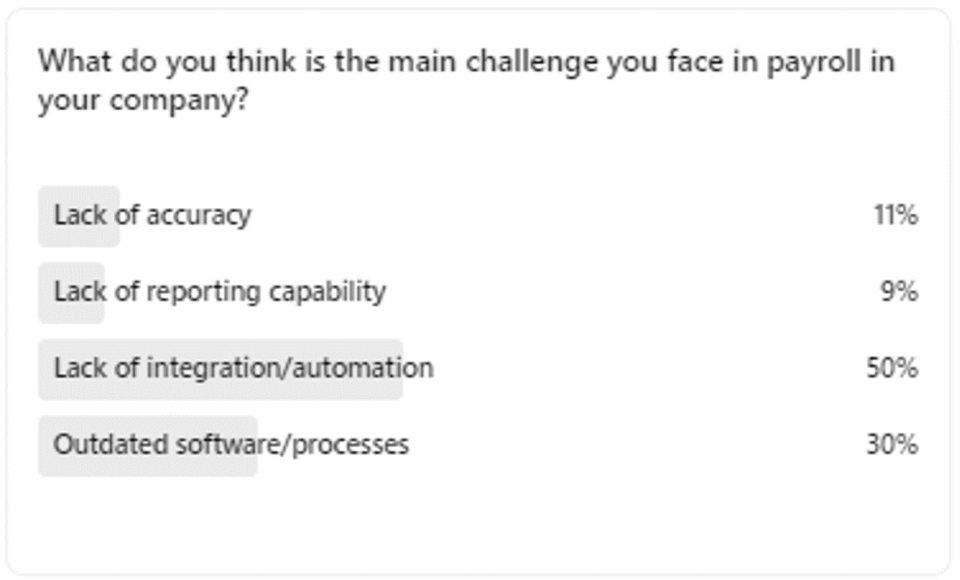

Lack of integration and automation highlights the arduous task many face with convoluted systems which have not been updated over time, especially when companies grow or when a merger and acquisitions occurs.

Not only does this often result in duplication of data, which is one of the main risks for data inaccuracies, but also increases reliance on few staff who know and understand what to do in several different systems, and ultimately how to bring this data together. Coupled with the present-day scenario where hybrid workforce is on the rise, niche job skills are in high demand, and labour is not constrained within borders, it’s no surprise that outdated software and processes was the second cited payroll issue receiving 31% of votes.

The reality is that payroll teams are now baffled with complex input of HR and payroll data from fragmented systems, leading to inaccurate data, deficiencies in reporting capabilities, inaccuracy in payroll, and even worse delay in pay-outs.

No wonder end of the month payroll is stressful. But it doesn’t have to be like that.

True many companies believe upgrading systems is just more expense whilst not being certain of the benefits. Yes, the initial software set up and installation has a cost, but as payroll costs thereafter decrease, we find most companies end up saving as much as 30% of overall spends.

Think of it like a new boiler. Once you’ve bought it you never look back, especially as you continue to reap the benefit with every future use.

Overcoming these payroll hurdles

Not all companies are equipped with or are ready to invest human resources in such a seemingly complex task. And that’s why a lot of businesses are turning to technology partners, like Zalaris, seeking consolidation and alignment of their often-ad hoc payroll solutions to create seamless payroll operations across increasingly global workforces.

By 2024, 60% of large organisations will try to address employee experience needs by deploying at least five HCM and digital workplace technologies

And so even more the need to find a suitable payroll technology that can seamlessly integrate and provide unify employee experience across a global organisation.

Relying on such credible partners for your HR and payroll can:

- Remove end of month office stress

- Remove reliance on few staff

- Remove expense of buying, maintaining, and supporting expensive payroll systems

- Reduce errors and liability

- Increase staff wellbeing, removing payroll stress and recouping time for HR initiatives

- Increase retention – HR have time to drive the business goals

- Benefit from expert timely legal and GDPR compliance

- Benefit from improved payroll visibility with easy reporting

- Benefit from global reporting to analyse your business

- Benefit from tech experts available 24/7

- Benefit from cost savings due to utilising your providers economies of scale

- Benefit from future proofing payroll – no outdated systems

- Benefit from peace of mind

Payroll is critical function, and even more so during times of crisis, and companies must ensure that it is reliable and accurate no matter the disruption. Digitalising payroll workflows and creating a single, global system are the first steps in cementing payroll dependability for the future.

– Richard E. Schiørn, EVP Solution & Delivery for Global Managed Services at Zalaris.

At Zalaris we aim to decrease our client’s overall payroll costs by around 30% from their present position when they move to us. We can also spread the implementation cost over the contract period avoiding financial sign offs, meaning the decision to come to us is based more upon the agreement that a new, more cost-efficient system to free up your staff is the right step forward.

Just get in touch with our experts and we’ll help you get started on your future proof payroll journey.